The benefits of OCR in insurance are accelerating how insurers manage documents and data. By turning paper files, scanned images, and handwritten forms into structured digital data, Optical Character Recognition (OCR) enables automation across claims processing, fraud detection, policy servicing, and more.

Forward-thinking insurers are reporting up to 90% error reduction and 70% cost savings thanks to OCR-driven automation. Whether it’s accelerating claims from days to minutes or eliminating manual data entry, OCR is delivering measurable, scalable impact across the insurance value chain but to understand these transformative results, it’s essential to first grasp what OCR technology actually does.

What Is OCR and Why It Matters in Insurance

Optical Character Recognition (OCR) is a technology that extracts text and data from documents like PDFs, images, and handwritten forms. In insurance, OCR is especially powerful for digitising:

– Claims forms

– Medical reports

– Invoices

– ID documents

– Policy applications

The key benefits of OCR in insurance stem from its ability to replace time-consuming, error-prone manual processing with real-time, accurate automation. This improves customer satisfaction, operational efficiency, and compliance addressing the very challenges that are driving more insurers to embrace this technology.

Why Are Insurers Turning to OCR?

Insurance companies face growing pressure from:

– Slow processing times that frustrate customers

– High labor costs for data entry teams

– Human errors that lead to compliance issues

– Ineffective fraud detection through manual checks

The benefits of OCR in insurance directly address these challenges by enabling:

– Faster turnaround

– Lower operational costs

– Increased data accuracy

– Scalable fraud prevention

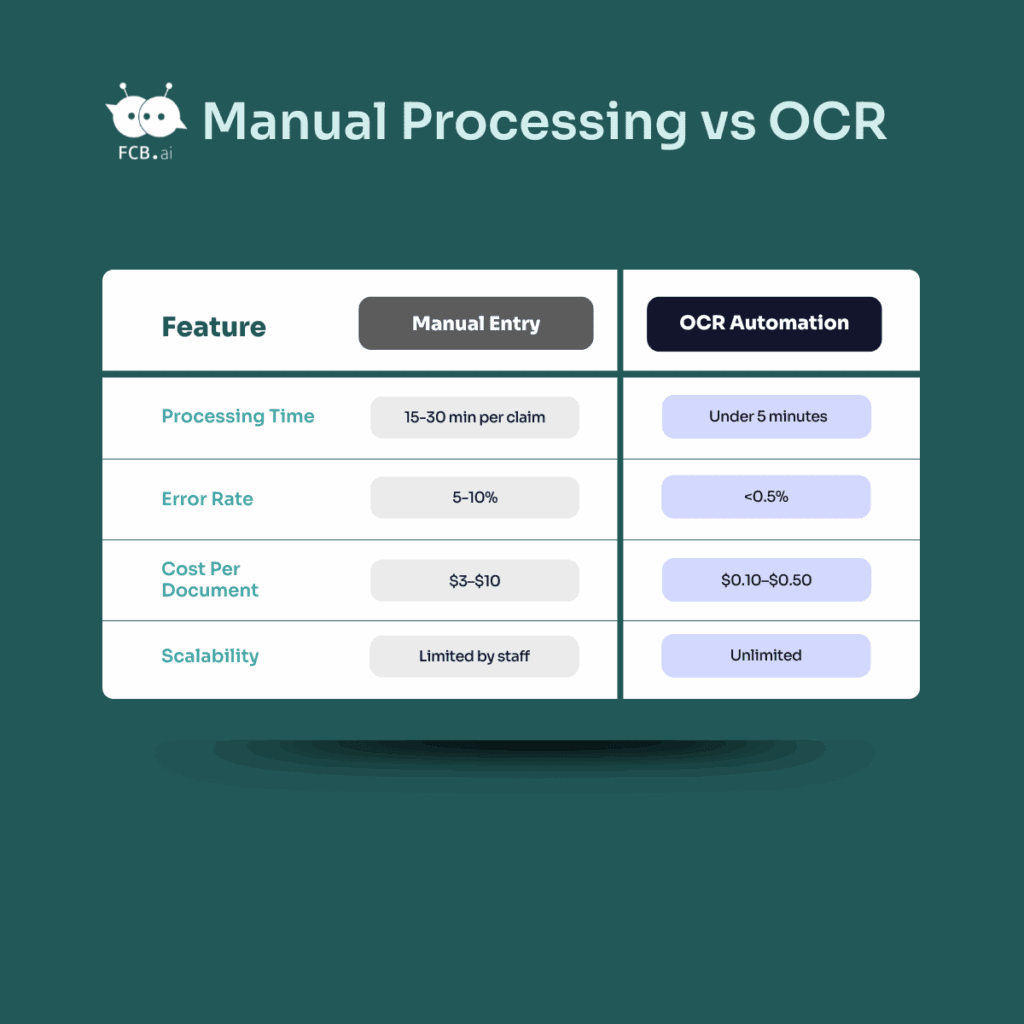

These advantages become even more apparent when we examine the stark differences between traditional manual processing and OCR-enabled automation.

Manual Processing vs. OCR: A Clear Comparison

With OCR, insurers can automate data extraction, validate information instantly, and push data directly into core systems or RPA workflows enabling straight-through processing. These impressive metrics aren’t just theoretical, leading insurance companies are already achieving these results in real-world applications.

Real-Life Use Cases: Benefits of OCR in Action

FCB’s AI-powered OCR solutions are transforming insurance operations, demonstrated through real-world case studies including our successful partnership with a major South African insurance group and additional industry scenarios where we believe OCR technology can drive meaningful change.

Case Study 1: Automating Policy Document Processing

Challenge: A brokerage wasted 35+ hours weekly manually processing policies and loans, delaying approvals and increasing compliance risks.

Solution: FCB.ai’s Smart OCR automated data extraction, categorisation, and validation, with exceptions flagged for review.

Where Utilised: Policy verification, loan approvals, and compliance teams.

Result: 65% faster processing, loan approvals in hours (vs. days), 40% of staff redeployed to customer roles, and ROI in <4 months.

Case Study 2: Enhancing Compliance Accuracy

Challenge: An insurer faced rising costs and regulatory risks due to error-prone manual document checks.

Solution: FCB.ai’s OCR with real-time validation and adaptive AI replaced legacy systems.

Where Utilised: KYC/AML onboarding, claims/policy verification, and compliance workflows.

Result: 80% faster verification, 60% lower compliance costs, and fewer fines/errors.

Case Study 3: Centralising Customer Documents

Challenge: Disconnected data led to slow resolutions and frustrated customers.

Solution: FCB.ai’s Intelligent OCR digitised and indexed documents into unified customer profiles.

Where Utilised: Customer support, claims servicing, and debt recovery.

Result: 67% fewer repeat calls, 73% faster resolutions, higher CSAT scores, and improved recovery rates.

Quantifiable Benefits of OCR in Insurance

Implementing OCR in insurance leads to:

– Error Reduction: From 10% to <0.5%

– Faster Processing: From 30 minutes to <1 minute per document

– Cost Savings: Per-document costs drop by 70–90%

– Scalability: No need to scale staff during peak periods

– Better Compliance: Automated validation ensures audit-readiness

A large P&C insurer replaced 200 data entry roles with OCR + RPA, cutting processing costs by 70% while improving accuracy and turnaround time across claims, underwriting, and customer service.

With such compelling benefits proven across the industry, the question becomes how to implement OCR effectively in your own insurance operations.

Maximise the Benefits of OCR in Insurance with FCB.ai

The benefits of OCR in insurance go far beyond digitising documents, they unlock a smarter, faster, and more cost-effective way to run your insurance business. From claims and onboarding to compliance and fraud detection, OCR gives you the speed and precision modern insurance demands.

FCB.ai’s OCR solution is tailored to your workflows. We assess your current processes, design and deploy scalable OCR solutions, and integrate with your existing platforms. Our team ensures seamless onboarding, full training, and long-term support.

Want to unlock the full benefits of OCR in insurance?

Request a demo today to schedule a consultation and see how we can transform your operations through intelligent document automation.