Ever wondered if debt collection could be effortless? AI chatbots hold the key. Financial executives face daunting challenges in this regard. Explore how AI chatbots tackle these challenges and reshape debt collecting strategies.

‘With South Africans spending 75% of their take home pay on debts, debt collection firms face a tough challenge in recovering owed amounts.’ *

The Debt Collection Conundrum

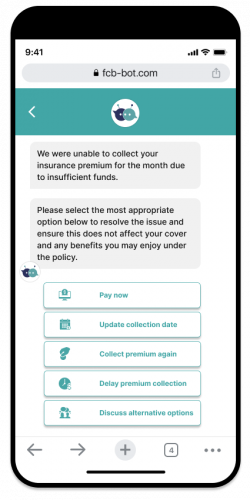

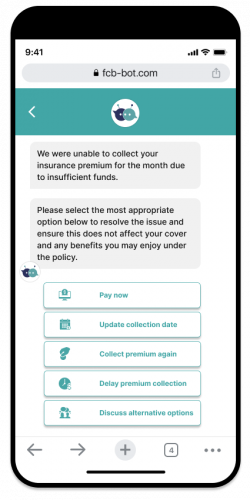

Financial executives face a myriad of challenges when it comes to collecting debt. From navigating complex regulatory frameworks to ensuring seamless communication with debtors, the process can be daunting. Traditional methods often lead to inefficiencies, delays, and increased operational costs. This is where AI chatbots step in as a game-changer.

1. Automating Compliance Checks

Regulatory compliance is a top concern for financial executives. AI chatbots excel in automating compliance checks by swiftly analysing legal documents using eKYC (know your customer), ensuring that debt collection processes adhere to all applicable laws. This not only mitigates legal risks but also frees up valuable time for financial executives.

2. Personalised Communication at Scale

AI algorithms have the ability to analyse vast amounts of customer data, enabling insurance companies to tailor their services to individual preferences. From personalised policy recommendations to targeted communication strategies, AI empowers executives to create a customer-centric approach that fosters long-term relationships.

3. Tailoring Strategies to Industry Needs

Debt collection strategies require a unique approach. AI chatbots analyse industry-specific data, allowing financial executives to tailor strategies that align with the nuances of the industry. This targeted approach maximises recovery rates while minimising friction.

4. Addressing South African Debt Collecting Challenges

South Africa presents its own set of challenges in debt recovery, from diverse languages to regional variations. AI chatbots, equipped with language translation (multilingual) capabilities and localised knowledge, bridge these gaps. Financial executives can navigate the intricacies of South African debt recovery with ease and cultural sensitivity.

5. Data-Driven Decision Making

AI chatbots harness the power of data analytics, providing financial executives with actionable insights. By analysing historical data, these chatbots enable informed decision-making, helping executives refine debt recovery strategies over time. This data-driven approach enhances efficiency and boosts overall performance.

Embrace AI Chatbots with FCB.ai

AI chatbots are not just alleviating the pain points associated with debt collection; they are revolutionising the entire process. By automating compliance checks, personalising communication, tailoring strategies to industry needs, addressing regional challenges, and offering data-driven insights, AI chatbots empower financial executives to navigate the complexities of collecting debt with newfound efficiency and effectiveness.

As industries evolve, so must debt collecting strategies. Embracing AI chatbots is not just a forward-thinking approach; it’s a necessity in today’s dynamic financial landscape. Whether you’re in insurance or operating in the unique context of South Africa, AI chatbots are the key to unlocking a new era of streamlined, data-driven debt collection strategies.

Interested in learning more about how FCB.ai can help transform your debt collection strategy?

* Source: Businesstech.co.za