In the insurance world, boosting customer retention by just 5% can mean a huge 95% jump in profits due to the life-time value of the retained customer. Yet, insurance company leaders are up against a big challenge in keeping customers from jumping ship to numerous eager competitors.

This tough situation highlights the need to adopt cutting-edge solutions quickly. Artificial Intelligence (AI) is set to reform how companies retain their customers and enhance engagement with them. In this article, we’re focusing on the crucial role of strong customer retention strategies in insurance using AI technology.

Boosting customer loyalty by just 5% can mean a huge 95% jump in profits

Understanding Customer Retention in the Insurance Industry

In the South African insurance sector, up to 50% of sales can be lost due to failed first premium collections. The high failure rate necessitates targeted improvements to enhance retention and financial stability within the sector.

Quick and easy communication is key to building strong relationships with new and existing policyholders. It’s not only about having good prices but also about offering great service and tailored experiences.

A study by Accenture found that 91% of consumers are more likely to work with brands that recognise, remember, and provide clear solutions to challenges met by consumers, underlining the significant impact of personalised experiences on customer loyalty and retention.

Customer Retention Strategies

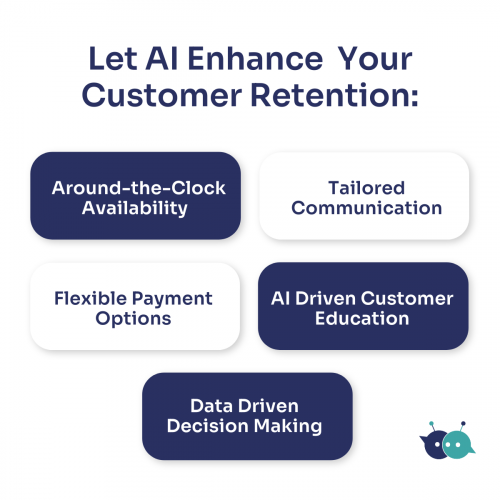

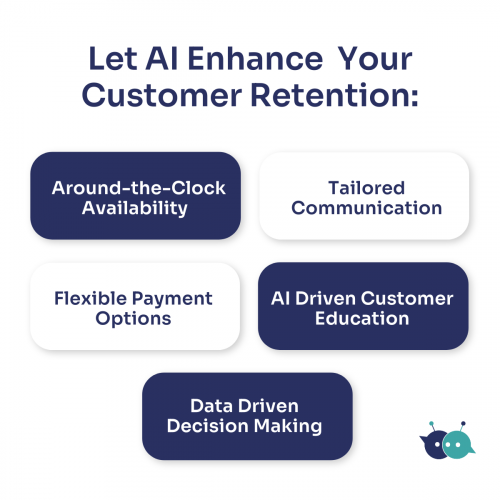

Embracing automation and artificial intelligence (AI) has become pivotal, offering personalised immediate customer support through chatbots, and proactive churn prevention. It also allows from unlimited scalability in being able to respond to customers on their preferred channel of communication – such as WhatsApp or Messenger.

Personalised Efficiency AI Customer Experiences:

AI algorithms have the ability to analyse vast amounts of customer data, enabling insurance companies to tailor their communication to individual preferences. From personalised policy recommendations to targeted communication strategies, AI empowers executives to create a customer-centric approach that fosters long-term relationships.

AI-powered chatbots provide immediate assistance to policyholders, addressing queries and concerns in real-time. This not only enhances customer satisfaction by removing frustrating phone calls and disconnects, and also plays a pivotal role in customer retention by establishing a responsive and accessible communication channel.

Insurance executives must embrace the transformative power of AI to stay ahead of the competition. By implementing advanced customer retention strategies supported by AI, insurers can not only enhance customer satisfaction but also lay the foundation for sustainable business growth. The future of the insurance industry lies in the hands of those who recognise the potential of AI and leverage it to build lasting connections with their policyholders.