Unlock the Power of AI to Reduce Customer Churn in South African Insurance

Imagine a world where a 5% reduction in customer churn could boost profits by up to 95%. In the highly competitive South African insurance market, this is not just a possibility, but a reality being shaped by Artificial Intelligence (AI).

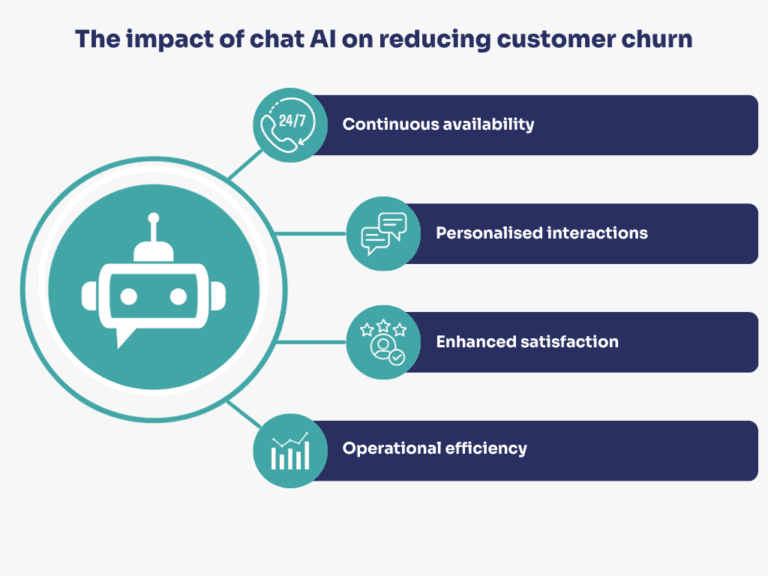

This article delves into the critical issue of customer churn in the insurance sector and unveils how AI, particularly chat AI, is emerging as a vital tool for enhancing customer retention. It’s a journey through the transformative power of AI, from mere buzzword to practical solution, reshaping the landscape of customer loyalty and engagement.

Nearly 60% of insurance executives believe that superior customer service experiences significantly impact differentiating them from the competition.

AI for 24/7 Immediate Customer Service

The integration of AI in providing round-the-clock customer service is a game-changer in the South African insurance sector. AI-driven platforms offer immediate response capabilities, drastically reducing the frustration of long wait times. This 24/7 availability ensures that customer inquiries are addressed promptly, regardless of the hour, enhancing overall customer satisfaction. More importantly, this constant accessibility does not strain resource costs.

AI systems efficiently handle a high volume of queries without the need for additional staffing, translating into significant cost savings for insurers. By delivering advanced assistance at any time, AI is not only improving the customer service experience but also driving cost efficiencies, making it an invaluable tool in the competitive insurance market.

AI-Driven Personalisation in Insurance

In the evolving landscape of the South African insurance industry, personalisation is the key to customer loyalty, and AI is the master key unlocking this potential. AI-driven personalisation is revolutionising how insurers interact with their clients, offering tailored policy recommendations and dynamic pricing models. These advancements are not just about selling more policies; they’re about understanding each customer’s unique needs and risks, thereby fostering deeper trust and engagement.

The effectiveness of AI in personalisation extends beyond risk assessment. Insurers now utilise AI to anticipate customer needs, suggest relevant add-ons, and even predict life events that might necessitate policy adjustments. This level of personalisation leads to a more satisfied and loyal customer base. A recent study highlighted a staggering 20% increase in customer satisfaction attributable to AI personalisation in the insurance sector.

Predictive Analytics and Customer Retention

Predictive analytics stands at the forefront of AI’s arsenal in combating customer churn. In this data-driven approach, AI scrutinises vast amounts of customer interaction data, identifying patterns that might indicate a risk of churn. This proactive stance allows insurers to engage with customers before they decide to leave, addressing their concerns and improving overall satisfaction.

The potential of predictive analytics in customer retention is immense. For instance, insurers can use these insights to offer timely policy renewals, personalised discounts, or special services, effectively reducing the likelihood of customer departure. A report from the Insurance Tech Report revealed that companies implementing predictive analytics witnessed a 10% reduction in customer churn, a testament to the effectiveness of this AI application.

AI in the South African insurance industry is more than a futuristic concept; it is a present-day reality reshaping customer experiences and reducing churn. The integration of AI in insurance is a win-win, offering enhanced customer satisfaction and increased profitability.