Transforming South Africa's Insurance Landscape with the Power of AI Chatbots

The South African insurance landscape is undergoing a radical transformation, propelled by digital innovation. Central to this transformation is the advent of AI chatbots, which are redefining customer interactions and service delivery. Leveraging the advancements in conversational and generative AI technologies, like ChatGPT, AI chatbots are emerging as a crucial tool in addressing the unique challenges and opportunities within the insurance industry.

It is anticipated that insurance AI chatbots will manage over 85% of customer conversations within the next five years.

The Drive for Digital Transformation in Insurance

As detailed in the 2023 Africa Insurance Outlook Update, South Africa’s insurance sector is swiftly moving towards digitalisation. AI chatbots are at the forefront of this shift, enhancing operational efficiency and customer service. The integration of AI in customer service platforms is not just a technological upgrade but a strategic necessity, enabling insurers to handle inquiries and process claims more efficiently, thereby improving customer satisfaction and retention.

Advancing Digitalisation in South African Insurance

Many insurers are lagging behind in their digitalisation journey, often due to relying on internal development teams under significant backlog pressure, lacking the specialised expertise and data required for crafting successful AI solutions in insurance. With the rise of digital solutions in the finance sector, an Insurance chatbot in South Africa has become an indispensable tool for revolutionising customer engagement and efficiency in the insurance industry.

Addressing Industry Challenges with AI Chatbots

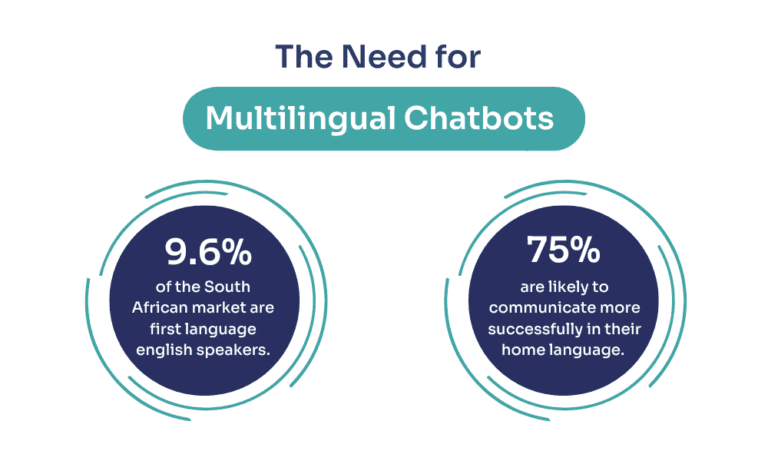

The sector faces specific challenges such as catering to a diverse customer base and navigating economic volatility. AI chatbots, with their ability to communicate in multiple languages, offer an effective solution for engaging a culturally diverse clientele. They are instrumental in automating routine tasks, which is especially crucial in managing costs and maintaining efficiency in a fluctuating economic climate.

Advancements in Conversational and Generative AI

The post-ChatGPT era has seen significant advancements in AI technologies, making AI chatbots more sophisticated and capable of understanding and responding to customer queries with remarkable accuracy. For instance, it’s reported that chatbots can now answer 80% of standard questions accurately.

Current AI advancements enable insurance companies to ring-fence secure data, integrating it with GPT technology for personalised chatbot interactions. This enhances customer experiences in claims and policy management by providing tailored advice and updates. The approach not only streamlines operations but also boosts customer satisfaction, resulting in higher retention rates.

The Need for 24/7 Accurate Assistance

In today’s fast-paced world, immediate responses are not a luxury but a necessity. AI chatbots excel in providing 24/7 assistance, meeting customer expectations for instant support. This constant availability not only boosts customer experience but also allows human agents to focus on complex, value-added tasks.

A study by Dashly found that 64% of internet users appreciate 24/7 service provided by chatbots

The Shift to Messaging Platforms Over Telephonic Engagements

There is a noticeable trend in South Africa towards using messaging platforms like WhatsApp over traditional telephonic engagements. AI chatbots are ideally suited for these platforms, providing a mix of convenience and immediacy. They adeptly handle text and voice messages, offering a seamless and efficient communication channel that aligns with contemporary communication preferences. WhatsApp has over 10-million users in South Africa, making it a vital platform for customer engagement.

Technical Realism in AI Chabot Integration

It’s essential to acknowledge that AI chatbots are not meant to entirely replace human interaction. Instead, they are designed to enhance and streamline human resource capabilities. AI chatbots excel in automating routine tasks, enabling human agents to concentrate on more nuanced and empathetic interactions.

Chatbots have seamless Integration into Existing Systems

Fintech companies like FCB.ai play a pivotal role in integrating AI chatbots into legacy systems within insurance companies. They ensure that these sophisticated tools are seamlessly integrated into existing infrastructures, providing continuous support and ensuring minimal disruption to current operations.

AI’s Impact on Employment

Far from replacing human employees, AI chatbots are reshaping the workforce by taking on routine and administrative tasks. This shift allows human resources to be reallocated and optimised, focusing on strategic and creative tasks that require human insight.

AI chatbots are spearheading a new era in South Africa’s insurance industry. By tackling unique market challenges, bolstering human capabilities, and offering seamless integration with existing systems, AI chatbots are setting new benchmarks in operational efficiency and customer engagement. As this technology continues to evolve, it promises to open up new pathways for innovation and growth in the sector.